The quick method for HST comes up a lot with my clients as it is a perfect fit for small freelancers and designers. The quick method is ideal for businesses that have a low amount of taxable purchases made in regular operations. Before I can illustrate the substantial impact that the quick method can have I first will explain how HST generally works.

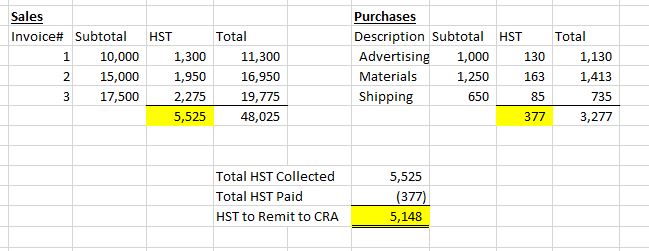

The process of regular HST.

If you’re a company registered to collect HST what the process is:

1. You charge 13% HST on your sales

2. Add up all the HST collected from sales at the end of the reporting period

3. Add up all the HST paid on purchases at end of the reporting period

4. Pay the government the difference.

An Example:

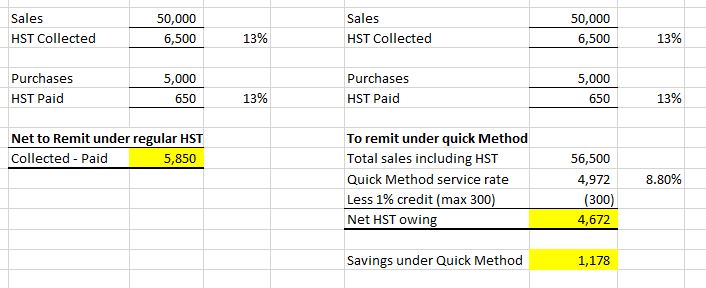

Quick Method for HST

For the quick method of HST instead of taking sales and removing purchases you use a flat rate (depending on what type of business you are) and remit that amount in lieu of taking ITC on purchases. The best way to explain this is to illustrate it in an example first.

Let’s say you’re a designer who doesn’t have a lot of expenses, you may have some software licenses, and you may purchase an image or two on occasion. Most of the time you will end up remitting almost all the HST you collect back to the government. For this example we will use the quick method service rate of 8.8%.

Essentially you are trading off the ability to remit purchases for to remit a flat amount. However that’s not the best part. You can still take credits from purchases of capital purchases such as computers, vehicles, improvements, furniture and fixtures, etc. This means that if you bought a big piece of capital property you would also be able to reduce the amount you remit to the government by the amount of HST paid for on that purchase!

So who is eligible?

The criteria simply is:

1) You cannot have more than 400,000$ sales including HST (353,982.30$ less HST) in your last 365 day period. If you are a new business you would need to have reasonable expectations that you will not have the mentioned sales amount.

2) You are not any of these listed business types:

For a lot of organizations the quick method may not be available, however for the ones that are eligible it can end up saving a lot of cash up for not much effort.

- Erik

If you have any questions or concerns about your tax scenario, feel free to reach out to me. As always I provide a free consultation on your tax situation.

If this post was informative feel free to subscribe below to be notified when I update my blog.