A bit cleaner than my work space.

Before writing in more detail about tax deductions I thought that I should spend some time on the Canadian tax topic Integration. I think that it’s important for business owners to understand integration. Integration as a basic foundation of income knowledge, can help the business owner make decisions in the day-to-day operations. With the basic understanding of integration we will go through an example of the potential tax advantage of being incorporated.

Tax Integration

The purpose of integration is to ensure that all business structures pay the same amount of tax. This means that if you are self employed, a corporation, or a partnership you would pay the same tax for similar transactions. Canadian Integration in most cases is close to perfect however in some provinces and income combinations you can see a small benefit or a small loss. For the purposes of this illustration those benefits or losses don’t have a material impact on the calculations. A general picture of the idea of integration is as follows:

In both examples the amount of tax payable is the same. However integration doesn’t generally work out perfectly like above however it usually ends up to be a small difference.

Do you need access too all the income you generate?

In the example above we can see that if you draw all the money out of your corporation it really has no difference between the amounts of tax you owe. However one of the biggest reasons I would recommend someone incorporate (assuming you’re not deemed an employee, see at the end of this example) is if they don’t need access to all the income they generate. Let’s go through an example.

Let’s say you’re a relatively new freelancer and you just finish up your first year with the following financial results:

You’re looking at about 70,000$ income to be taxed either inside a corporation or outside a corporation.

Now to look at an example of a personal budget:

So in this case you are making about 70,000$ before tax but only need access to about 41,000$ after tax. So we calculate the amount of salary needed to pay out to get 41,000$ after tax:

In this case we would need to pay roughly 52,514.6$ in salary to obtain 41,000$ after tax.

Then we can plug this salary amount into the corporate example and end up with a tax burden of 13,924.10 (11,514.60 in deductions on salary paid, and 2409.50$ in corporate tax).

We can then compare this number to the amount we would need to pay if we were not incorporated:

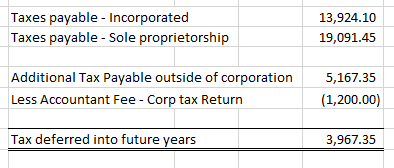

Compare that to the total taxes payable vs tax payable outside a corporation:

In the example of an incorporation we need to add an amount for a tax return as most individuals wouldn’t feel comfortable doing their own corporate tax return. In this case we take an additional 1200$ to pay your accountant to do your books.

In this example the savings are minor (3,967.35), however this amount could be increased by a few thousand if the individual paid dividends which would remove the need to contribute to CPP (individual preference).

However it’s important to understand:

1) If the gap between the money you earn in the company and the money you need personally grows, the amount of tax saved becomes greater.

2) If the amount of money generated in your business grows and you enter the higher tax brackets, the amount of tax saved becomes greater.

In conclusion if you see a big gap between the money you need to live and the money you are generating in your business, it might be time to start looking at utilizing a corporation to defer the taxes payable.

Contractor’s tests

I mentioned above that incorporation only works if you are not considered an employee. There are various rules that need to be followed to ensure you’re not an employee, or a Personal service business.

These rules or tests focus on the relationship between the employer and the employee or the contractor and the client. Generally I would recommend checking with an accountant if you’re unsure. Most conversations I have had with clients seem to have the client not looking critically at their situation, which ends in them ruling in favor of themselves, which can potentially come back and cause issues down the road.

Other benefits of incorporation:

Limited Liability

One of the other major benefits of a corporation is limited liability. If you are sued as a corporation it allows you to protect your personal assets and avoid losing everything you have. There are various situations where you may not be as protected against liability in a company, especially as a director, so if you are looking to incorporate to avoid liability this is a conversation you would want to have with a professional.

This could be relevant depending on a freelancers industry of work/exposure.

Continuous existence

The corporation continues to exist even when shareholders and directors pass on. This would allow the ownership of the corporation to pass on to the heirs of the shareholders’.

This most likely isn’t relevant for a new freelancer.

Income Splitting

Payment of dividends/reasonable salary to a lower income spouse/adult child to reduce tax owning.

This is potentially relevant if your partner is not earning much income. You could give your partner dividends or a reasonable salary which would be subject to a lower tax rate.

Separate Entity

As a separate entity clients generally are able to better understand their books and financial reports as it doesn’t integrate with their personal tax.

This is most likely less relevant for a tech freelancer as generally transactions are low removing the need for a separate entity to reduce confusions.

Conclusion

In today’s job market there is a high demand for freelancers and contract employees. I see too often contractors/freelancers that could benefit from incorporating full-time and I hate to see individuals paying more tax than needed. Maybe you have that friend who told you it wasn’t worth it to incorporate because he’s been your mentor this far. However if you think the above information is close to your situation then maybe it’s time you reach out to a professional.

- Erik

If you have any questions or concerns about your tax scenario, feel free to reach out to me. As always I provide a free consultation on your tax situation.

Also stay posted for my next topic on Car and use-of-home expenses for your small business.